Decentralized Finance (DeFi) & the Future of Global Business Transactions

In recent years, the financial landscape has experienced a paradigm shift, driven largely by advancements in blockchain technology and the emergence of decentralized finance (DeFi). This innovative sector is not merely a technological trend but represents a fundamental rethinking of how financial services can be delivered. DeFi utilizes smart contracts on blockchain networks to create financial instruments that operate without the need for traditional intermediaries such as banks and brokers. As DeFi continues to evolve, its implications for global business transactions are profound, promising increased efficiency, inclusivity, and transparency.

The foundation of DeFi lies in its ability to democratize access to financial services. Traditionally, financial systems have been characterized by significant barriers to entry, often excluding individuals and businesses in developing regions from essential banking services. With DeFi, anyone with internet access can participate in financial activities, such as lending, borrowing, trading, and investing, thereby broadening the reach of financial services to underserved populations. This democratization not only empowers individuals but also fosters economic growth by enabling small and medium-sized enterprises (SMEs) to access capital that might otherwise be unavailable through conventional channels.

One of the most significant advantages of DeFi is its ability to facilitate cross-border transactions with reduced friction and lower costs. Traditional international business transactions often involve multiple intermediaries, each charging fees and adding time to the processing of payments. In contrast, DeFi platforms can streamline these processes using blockchain technology, which allows for peer-to-peer transactions without the need for intermediaries. Smart contracts can automate and enforce the terms of agreements, thereby reducing the risk of disputes and the need for legal oversight. This efficiency can significantly enhance the speed of transactions, making it easier for businesses to operate on a global scale.

Furthermore, the transparency inherent in blockchain technology presents another cornerstone of DeFi's potential impact on global business transactions. Every transaction conducted on a blockchain is recorded on a public ledger, providing an immutable and verifiable history of all exchanges. This transparency can enhance trust among participants in a transaction, as it reduces the potential for fraud and misinformation. For businesses engaging in international trade, this trust is crucial, particularly in environments where regulatory oversight may be lacking. By leveraging DeFi, companies can protect themselves against counterparty risks, thereby facilitating smoother and more secure transactions.

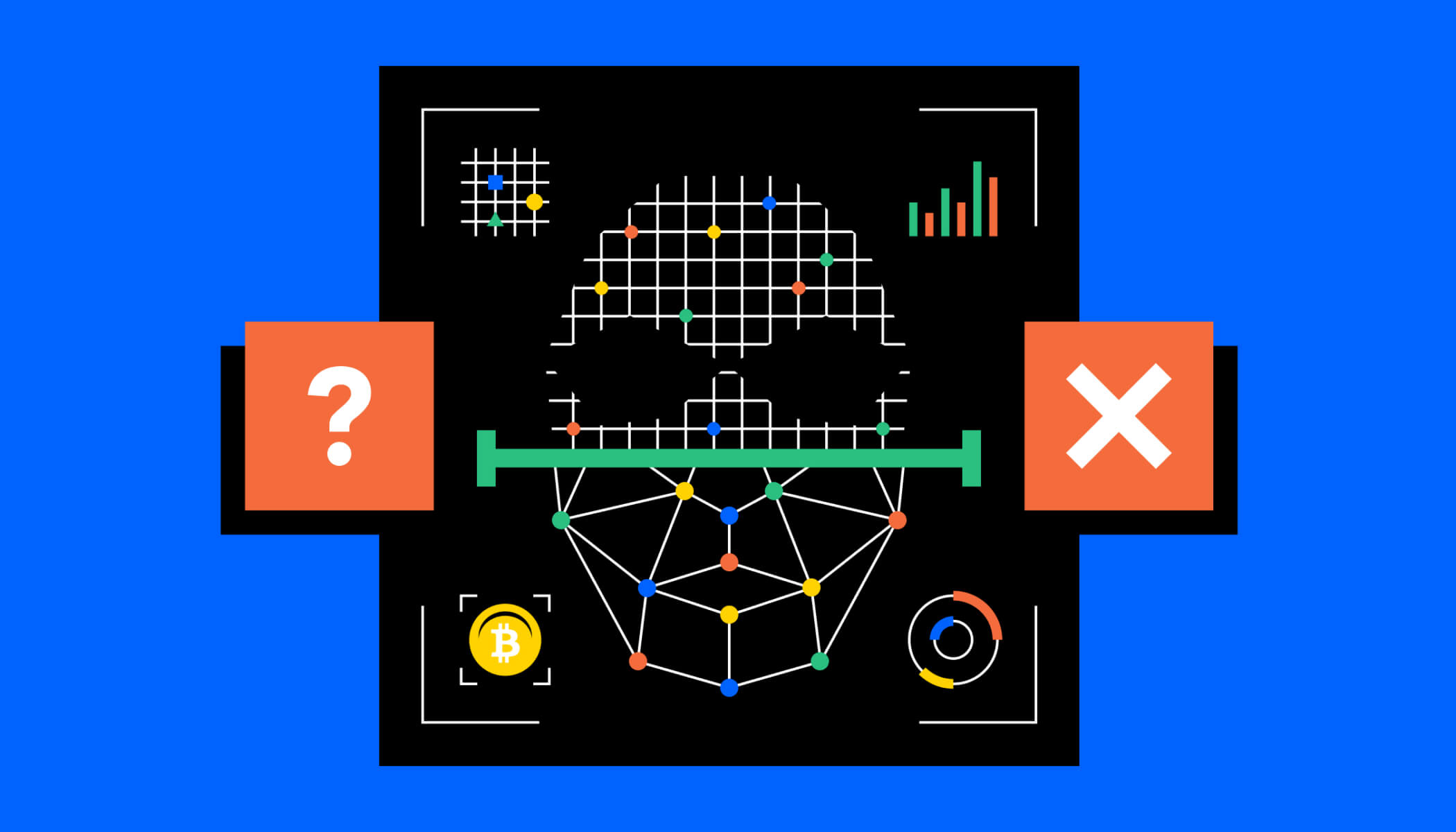

Despite the numerous advantages of DeFi, challenges remain that must be addressed for it to reach its full potential. The regulatory landscape surrounding cryptocurrencies and DeFi is still in its infancy, with governments around the world grappling with how to manage this rapidly evolving space. Regulatory uncertainty can hinder the adoption of DeFi solutions, particularly among institutional investors who may be hesitant to engage with unregulated financial products. Furthermore, the potential for smart contract vulnerabilities poses risks, as bugs or exploits could lead to significant financial losses. As the DeFi ecosystem matures, it will be essential for stakeholders to collaborate on creating regulatory frameworks that ensure consumer protection while fostering innovation.

Moreover, the environmental concerns associated with certain blockchain networks, particularly those that utilize proof-of-work mechanisms, cannot be overlooked. The energy consumption required for mining cryptocurrencies has raised alarms regarding the sustainability of DeFi. The industry must continue to innovate, exploring eco-friendly alternatives such as proof-of-stake and other consensus mechanisms that reduce energy usage without compromising security.

In conclusion, decentralized finance holds the promise of transforming the landscape of global business transactions. By eliminating intermediaries, increasing accessibility, and enhancing transparency, DeFi has the potential to create a more inclusive and efficient financial system. However, for DeFi to realize its full potential, concerted efforts are required to address regulatory challenges, ensure security, and promote sustainability. As these challenges are met, we may witness a future where global business transactions are not only faster and cheaper but also more equitable, ultimately contributing to a more prosperous and interconnected world economy.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0